Sellers in Arizona are protected by the Stigmatized Property Law which states:

Sellers in Arizona are protected by the Stigmatized Property Law which states:

“No criminal, civil, or administrative action may be brought against a transferor or lessor of real property or a licensee for failing to disclose that the property being transferred or leased is or has been:

– The site of a natural death, suicide, or homicide, or any other crime classified as a felony

– Owned or occupied by a person exposed to the human immunodeficiency virus, or diagnosed as having the acquired immune deficiency syndrome, or any other disease that is not known to be transmitted through common occupancy of real estate

– Located in the vicinity of a sex offender

Failing to disclose any fact or suspicion noted above shall not be grounds for termination or rescission of any transaction in which real property has been or will be transferred or leased.”

This AZ stigmatized property law has been interpreted by legal counsel to indicate there is no obligation for seller to disclose:

– a natural death, suicide, homicide or felony occurred on the property

– it was occupied or owned by a person with HIV or AIDS or any other disease that cannot be transmitted by living in the same property

– a sex offender lives in the area

Currently, all other material facts and latent defects are required to be disclosed by seller. A material fact is something that a reasonable person would deem important in making a purchase decision. A latent defect is an issue that may not be immediately noticeable or seen at all.

If you are planning to sell your home, but secretly want to make selling it difficult, please make sure you:

If you are planning to sell your home, but secretly want to make selling it difficult, please make sure you: A home in Arizona not served by municipal city water is likely to have a private well on property or use of a shared well. Under current FHA loan guidelines, a home can share a well with up to 3 other homes (so 4 homes total on shared well for FHA eligibility). What to know about well water in Arizona:

A home in Arizona not served by municipal city water is likely to have a private well on property or use of a shared well. Under current FHA loan guidelines, a home can share a well with up to 3 other homes (so 4 homes total on shared well for FHA eligibility). What to know about well water in Arizona: What is an

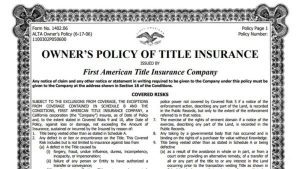

What is an  Title insurance protects a policyholder from any events that occurred before the issuance of the policy. The purpose of title insurance is to protect the policyholder against any losses that may arise from defects or liens associated with title.

Title insurance protects a policyholder from any events that occurred before the issuance of the policy. The purpose of title insurance is to protect the policyholder against any losses that may arise from defects or liens associated with title.