Happy 135th Birthday! If the Farmer-Goodwin property is not the oldest remaining home in Phoenix, it is certainly tied for first and features the most interesting history.

Originally built in 1883 by a saloon keeper on land he bought in 1880, it was then purchased by Hiram Farmer in 1886 for $3000 and situated on 160 acres. It served as Farmer’s home during his work as (what is now) Arizona State University’s first professor and principal.

So where does Goodwin fit in? When the railroad arrived in 1887, Farmer developed his land into one of Tempe’s early subdivisions but when he left the area in 1890, the property passed through several owners until it was acquired in 1897 by James Wilson, whose daughter Libbie married James Goodwin in 1902 and the house was deeded to her.

Goodwin was a successful Tempe rancher and businessman. He was a member of Theodore Roosevelt’s Rough Riders during the Spanish-American War and served in the Arizona State Legislature from 1915 to 1918. The house continued to be owned by the Goodwin family until the death of James and Libbie’s son, Woodrow Wilson Goodwin, in 1992.

The home represents Victorian-era architecture but lacks the “gingerbread” detailing often found in Victorian-era buildings. It is a two level adobe structure, rectangular and symmetrical in floor plan, with exterior adobe walls finished in plaster and scored with lines to simulate the look of cut stone.

Inside the house has a central hall with approximately equal-sized rooms symmetrically on either side of it. The room layout is identical on the upper level and access is by a stairway in the central hall, located in the very middle of the home.

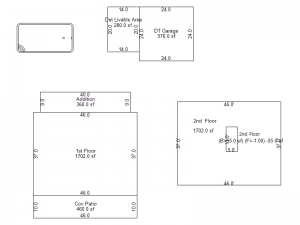

Today the mansion sits on a 25,000 sqft lot and features just over 4,000 sqft living space along with a pool and detached 2-car garage with guest casita. It resides (aptly) at 820 S Farmer Ave and is in the National Register of Historic Buildings.