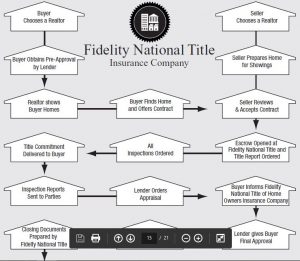

Here is how a typical 35-day purchase contract closing timeline may look for buying a home in Phoenix, AZ:

Here is how a typical 35-day purchase contract closing timeline may look for buying a home in Phoenix, AZ:

Day 0 – offer accepted so all contract timelines begin next day

Day 1 – start of buyer inspection period (usually 10 calendar days) to perform verification of all things important

Day 3 – receive SPDS (Seller Property Disclosure Statement) and CLUE (Comperhensive Loss Underwriting Exchange – insurance loss history experience) from seller (on or before this day)

Day 10 – deliver BINSR (Buyer Inspection Notice Seller Response) to seller (on or before this day) plus receive LSU (Loan Status Update) from lender (on or before this day)

Day 15 – receive BINSR seller response (on or before this day)

Day 20 – buyer decisions BINSR (on or before this day)

Day 21 – lender orders appraisal after BINSR is decisioned

Day 28 – receive appraisal (usually within a week from ordering)

Day 29 – buyer loan file submitted to lender underwriting

Day 31 – lender underwriting issues loan approval and loan documents ordered

Day 31 – evidence of any seller repairs must be provided (on or before this day)

Day 32 – title/escrow company receives buyer loan documents and finalizes closing statement

Day 33 – buyer and seller sign separately at title/escrow company

Day 34 – buyer performs final walkthrough at property and checks on any seller repairs

Day 35 – lender wires loan funds to title who sends file for recording at county

Day 35 – buyer obtains keys after confirmation of recording has been received

Of course, this is for a smooth closing without issues (say an appraisal shortfall which requires price/term renegotiations) or delays (such as buyer loan conditions that must be cleared prior to loan documents being issued). If either party is in breach of contract, the party not in breach may issue a cure notice to give notice to party in breach that they must correct the situation.

Deed is a document used to legally transfer title voluntarily from one person to another. The party giving the deed is the grantor and the party receiving the deed is the grantee. When a deed is recorded in the public record, it serves as written evidence of the titleholder’s ownership rights to a property.

Deed is a document used to legally transfer title voluntarily from one person to another. The party giving the deed is the grantor and the party receiving the deed is the grantee. When a deed is recorded in the public record, it serves as written evidence of the titleholder’s ownership rights to a property.