* SOLD WITH MULTIPLE OFFERS * Original owner has taken great care & pride of ownership shines! Over 15,000 sq ft private lot on secluded street with no HOA! Solid oak French door greets you into expansive foyer with vaulted ceiling living room & formal dining room. Also features a family room with cozy fireplace. And here come the updates… new wood-look tile, refreshed bathrooms, all new carpet & blinds just installed, interior just painted, new HVAC replaced only 2 months ago, roof replaced in 2012 with upgraded shingles, water heater only 2 years old & dual pane windows throughout. Bring all your toys… expanded parking slab can accommodate at least 6 vehicles behind custom wrought iron gates, plus there is an attached 2-car garage at rear of home.

Phoenix home for sale, marketed by Phoenix Realtor Andrew Robb.

MLS #: 6219906

Address: 9801 N 37TH DR

City: Phoenix

State: AZ

ZIP: 85051

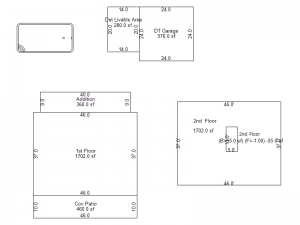

Lot Size: 15,442

Bedrooms: 3

Bathrooms: 2

Garages: 2

Pool: N

Looking to buy your first home in Phoenix? There are three loan types and one down payment assistance program that may be ideal for you, depending on your situation:

Looking to buy your first home in Phoenix? There are three loan types and one down payment assistance program that may be ideal for you, depending on your situation: